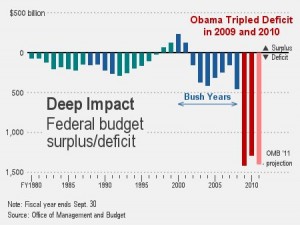

The past week has not showered our civilization in glory. President Obama spent the greater part of an hour at the State of the Union address ignoring an nation’s economic tribulation with an impressively deaf ear to what sage pundit Mark Steyn calls “our unprecedented world record brokeness“. Presidential candidate Newt Gingrich surveys the ever approaching economic calamity and states what we are missing is a drive to colonize the moon by 2020. His opponent for the Republican Party nomination for president viewing the debt bomb and destructive government driven healthcare initiative known as Obamacare as “nothing to get angry about.“

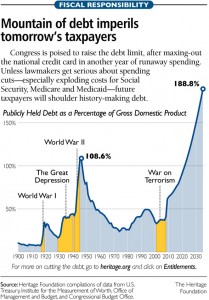

I was out with friends last night that decried the lack of seriousness of our so called leaders when it comes to western civilization’s critical debate of our times, our ability to recognize and respond to our impending debt crisis. It is obviously more enjoyable for politicians to talk about solar panels and moon colonies rather than the sacrifice and hard decisions necessary to structure a process that maintains our quality of life while preserving our fiscal capacity for that quality. All the difficult questions that are in front of us – what is a safety net and what is an entitlement, how are entitlements paid for and what security do they truly provide, what are national investments and what are national kickbacks, what reflects a caring society and what reflects a functioning one – so many important questions, so many others to consider, and yet, a deafening silence.

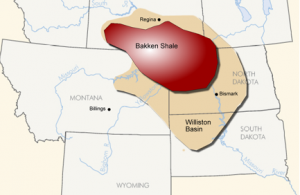

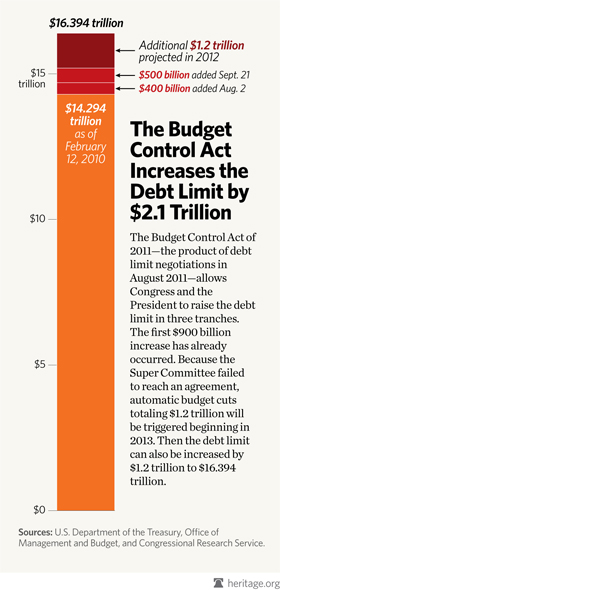

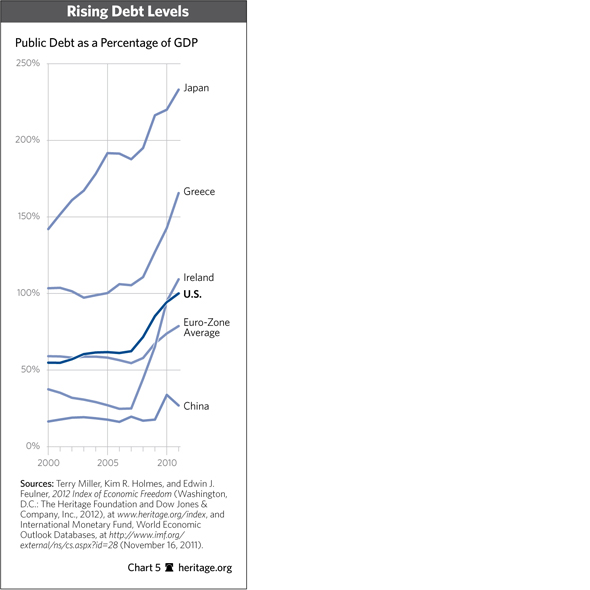

The extent of the problem has been reviewed many times on this blog but the cold hard facts never stop to send shivers up the intellectual spine of rational thinkers. The 31% of the entire liable debt of the 235 years of the existence of a national government of the United States was accumulated in the last three years, with no end in sight of the upward spiral. The Gross Domestic Product of the United States, the assembled market value of all the goods and services produced in a calender year is now less than the acquired debt. Confiscation by tax of the entire assets of the 400 richest Americans would no longer pay for more than one year of the nation’s annual deficit. The unfunded mandates of the United States estimated at over 100 Trillion dollars is more than the accumulated wealth of all the world’s economies. The estimated current individual responsibility of the debt to every living American is 48, 835 dollars and counting. The United States borrows 43 cents for every dollar it spends, and the chief country it borrows from is its ever growing adversary.

It seems we are at a crossroads, and the guides we have counted on our entire lives are clueless as to which road portends a better future. Leadership that forever gives us what we want, versus showing the way to what we need, is not, minus some profound epiphany, in the current crop of those who seek to lead us. The British politician Edmund Burke has been quoted as saying, “All that is necessary for the triumph of evil is that good men do nothing.” It looks like we are going to have to be our own guides on the correct road to national redemption, and pull our so called leaders kicking and screaming into recognition of the basic truths that face us all. In this case to paraphrase Burke we good men are going to have to overcome the do-nothings to inevitably triumph on the crossroads moment of our time.