The Congressional Budget Office is an independent non-partisan agency enacted by congress to help estimate the effect of laws on national revenue, review the budget process, and help make projections on the national debt. Earlier this week the CBO released their economic and budget issue brief, Federal Debt and the Risk of a Fiscal Crisis , and the Monster in the Attic fears were stirred in me all over again. U.S. government debt has grown so rapidly lately that it is projected to exceed the highest previous debt spiral in our history, the costs of World War Two, and proceed into territory considered by the CBO to be “unsupportable”. It is not clear what the fiscal crisis would look like if the United States, the primary economic engine in the world, were to face unsupportable economic choices, but it wouldn’t likely be anything the world would want to experience.

The economic consequences of an significantly growing debt to a nation in proportion to its gross domestic product creates typical economic responses learned in Economics 101. To pay for the debt, a growing portion of peoples savings would be diverted from personal investment in productive capital goods like consumer products or building factories. The reduced investment leads to lower economic output and therefore lower incomes. The increased levy of the government to pay for the debt requires higher marginal tax rates, further discouraging work and savings and further reducing output. The circular spiral to resultant lower available money to pay for the debt at the very time when the increasing debt demands more input leads to the need for other sources of income to pay for current programs or prevent collapse – printing more money inciting inflationary pressures, or borrowing from foreign sources increasing the long term indebtedness.

The ability for the government to borrow is predicated on the government investor’s willingness to trust that government’s ability to pay back the owed money. What happens if in difficult times, a fiscal crisis occurs where investors would lose confidence abruptly and either no longer lend or lend at a significantly higher interest? We don’t have to look far for an example – within the last twelve months the world wide recession drove Greece, a nation with a debt greater tha 110% of its gross domestic product into default, as the investors in that debt simply refused to put any more money down the black hole. An emergency fund by the European Union , of which Greece is a part, decided to staunch the bleeding temporarily and painfully lend Greece two hundred billion dollars to prevent the complete collapse of governmental services and secondarily debt payment. There is no indication this one time buttressing will prevent the progression of Greece’s debt crisis and its eventual default. Greece has a current GDP of 343 billion dollars and is the 27th largest economy in the world. What would happen if the United States, the number one economy in the world, with a GDP of 14 .5 Trillion dollars, would find itself needing to finance a similar debt?

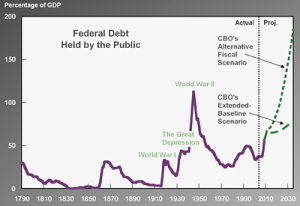

As seen in the CBO figure below the Federal Debt held by the public since 1790 has varied, driven high particularly by crises such as depression or war, but has been driven back by the vibrant health of the American economic engine. As recently as 2007, the percentage of debt to GDP stood at 36%. The deep recession and massive government investments like TARP, Auto industry Bailouts, and Stimulus packages, have driven the percentage to 62%, a level not seen since World War II. What particularly worries the CBO is the unbridled goals of further government investments over the next twenty years, such as entitlement expansion that remain unfunded. Without changes in fiscal policy, the CBO predicts the debt held by the U.S. public to exceed 110% by 2025, 180% by 2035. Within most of our lifetimes we will see the United States facing the current choices held by Greece. Who may I ask, will be our European Union to bail us out?

As the CBO simply states, the higher the debt, the greater the risk of a financial crisis. The process is fairly straight forward; the government’s all consuming appetite is driving it to seek more foreign investment to support its growing debt. Currently over 4 Trillion of the debt is owned by foreign investors, 1.7 Trillion by China and Japan alone. Any further economic downturn by the world’s greatest consumer nation would significantly effect the very countries who are the suppliers of much of those consumer goods, effecting their bottom line and eroding their further ability to underwrite our financial needs. The U.S. government would be left with very poor choices – restructuring the debt thereby even further burdening later generations, or printing money and driving inflation. The expected interest payments of the U.S. government annually to creditors expected by 2015 is 460 Billion, not taking into account interest hikes or further spending. The CBO predicts a simple 1 percent increase in inflation over the next decade would drive budget deficits 700 Billion dollars higher. Now we are clearly getting into that unsustainable range.

The solution? No matter what, the CBO says a combination of spending cuts and revenue increases adding to 5% of GDP is necessary to prevent an increase in the US debt to GEP ratio over the next 25 years, the equivalent of 20% of this year’s non-interest spending in the current budget year. Ouch!! That should convince anybody of the pain ahead and the need to get serious in holding our government leaders accountable for their desires to feed the problem, rather than solve it. Times a-wasting, people. 2010 is as good a time to start as any.